when does capital gains tax increase

The IRS lets you sell your home and pocket up. Check if your assets are subject to CGT exempt or pre-date CGT.

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

The capital gains tax on most net gains is no more than 15 for most people.

. Taking cash-back refinances could impact your tax bill when you sell your property. If your income grew by 5 2000 in 2023 your 2023 tax income of 42000 would bump you up to the 15 long-term capital gains tax rate if not for the inflation adjustment. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10.

If you realize long-term capital gains from the sale of collectibles such as precious metals coins or art they are taxed at a maximum rate of 28. Note that short-term capital gains taxes are even higher. In 1978 Congress eliminated.

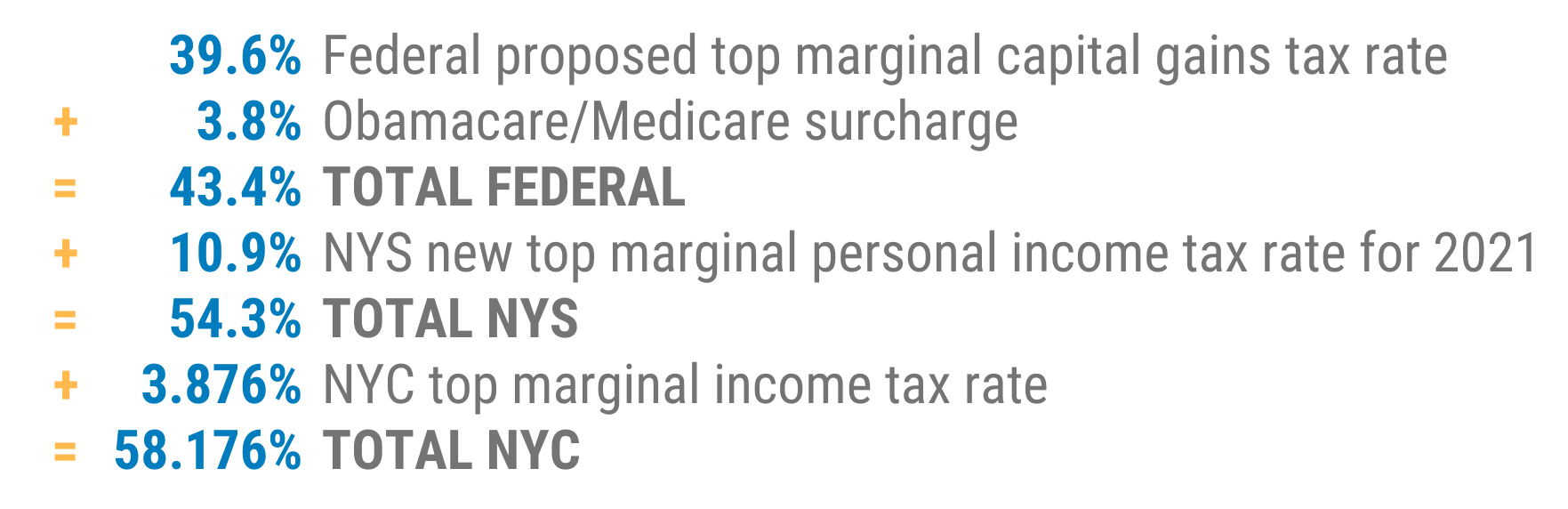

The proposal would increase the maximum stated capital gain rate from 20 to 25. Taxable capital gains 400000 1000000 -600000 Had there been no step-up price the taxable gain would have been 770000. Only Ireland has a higher rate.

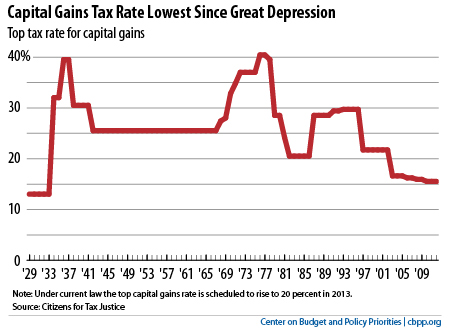

Inherited assets and capital gains tax How and when CGT applies if you sell assets you inherited including properties and shares. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. From 1954 to 1967 the maximum capital gains tax rate was 25.

But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20. If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0.

President Joe Biden would raise the top tax rate on capital gains and dividends to almost 49 between federal and state taxes. It imposes an additional 38 tax on your investment income including your capital gains if your modified adjusted gross income MAGI is greater than. The tax hike would apply to households making more than 1 million.

The Biden tax increases in the budget and BBBA would come at the cost of economic growth harming investment incentives and productive capacity at precisely the wrong time. If you sold a UK residential property on or after 6 April 2020 and you have tax on gains to pay you can report and pay using a Capital Gains Tax on UK property account. Step up price 600000.

The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. The investors regular income tax bracket applies to short-term capital gains which is usually higher than the capital gains tax rate unless a taxpayer is in the highest bracket. Can you avoid capital gains tax by refinancing.

250000 if married filing. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets. This means youll pay 30 in Capital Gains.

Foreign residents and capital gains tax How CGT affects your. The effective date for this increase would be September 13 2021.

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

The Tax Impact Of The Long Term Capital Gains Bump Zone

Irs How Much Income You Can Have For 0 Capital Gains Taxes In 2023

Capital Gains Tax In The United States Wikipedia

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Do The Math Cap Gains Tax Hike For New Yorkers Dsj Cpa

California State Government Will Lose Big From Capital Gains Tax Increase Econlib

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Real Estate Capital Gains Tax Rates In 2021 2022

Sweeping Reform Would Tax Capital Gains Like Ordinary Income Itep

What You Need To Know About Capital Gains Tax

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Chart Book 10 Things You Need To Know About The Capital Gains Tax Center On Budget And Policy Priorities

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

Biden To Float Historic Tax Increase On Investment Gains For The Rich Reuters

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)